A stock option is not a share of stock ! It provides the opportunity to exercise a right to buy a share of stock at a defined price (or « call. - ppt download

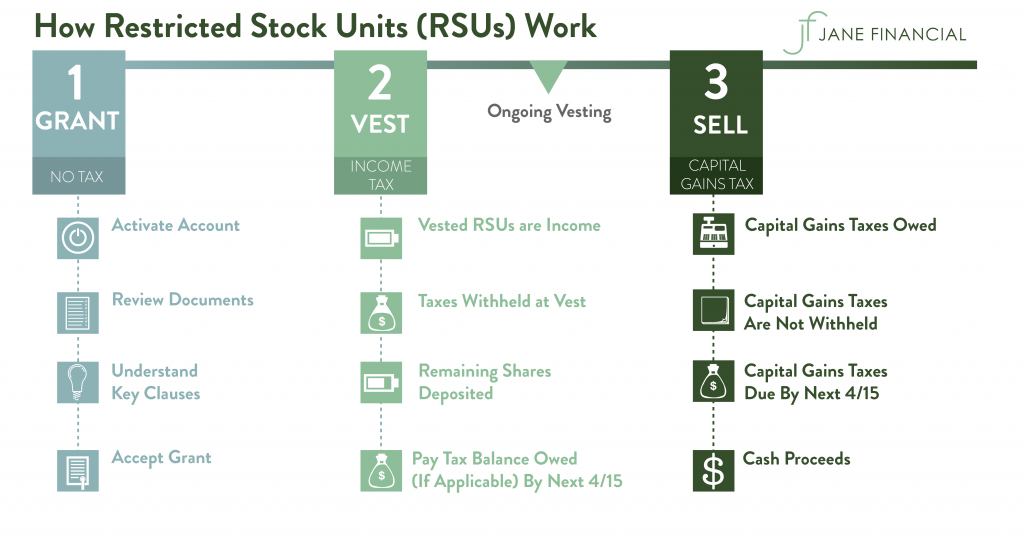

What the heck is an “RSU” and what do I do with mine? (and how is it different from a bonus?) - The Planning Center

:max_bytes(150000):strip_icc()/Employee-Stock-Option-fffca69f497d469f9e0f6b0da712b06d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)