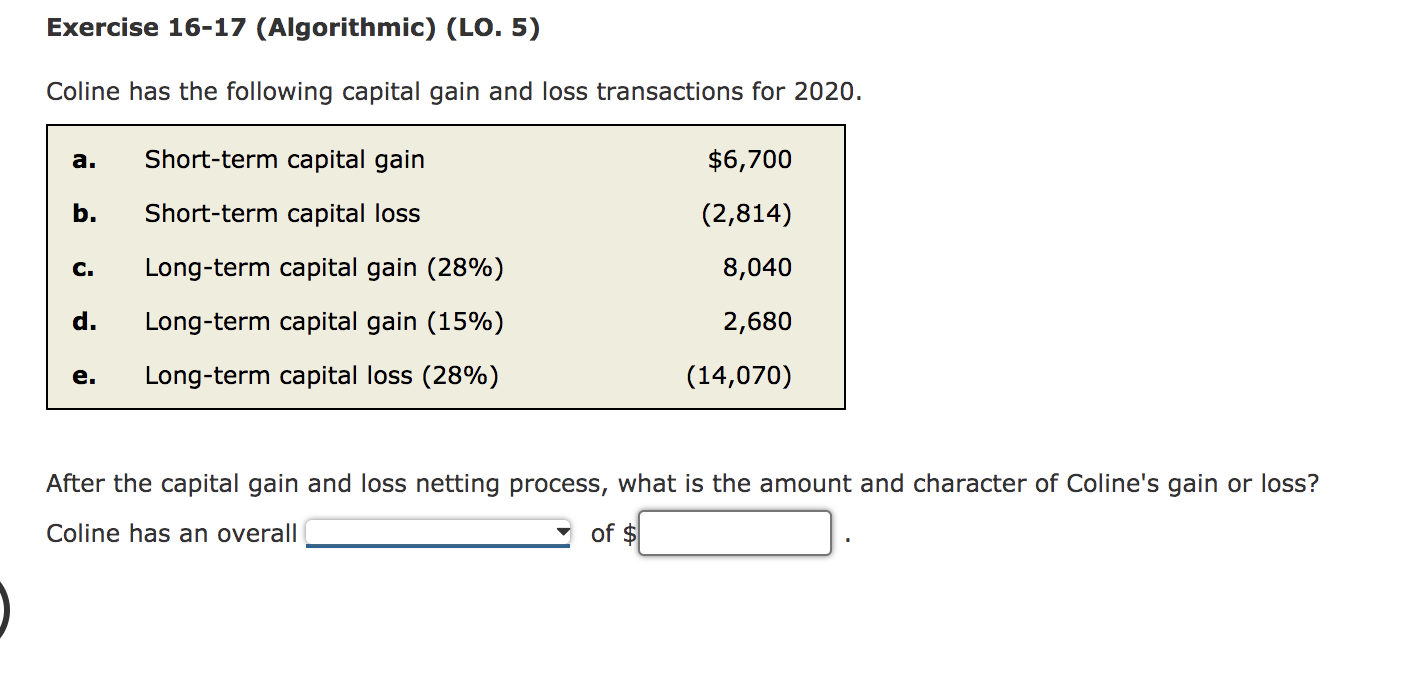

How much Tax does one have to pay for Long term & Short term capital gain? - Breakout Stocks (Nifty) - Quora

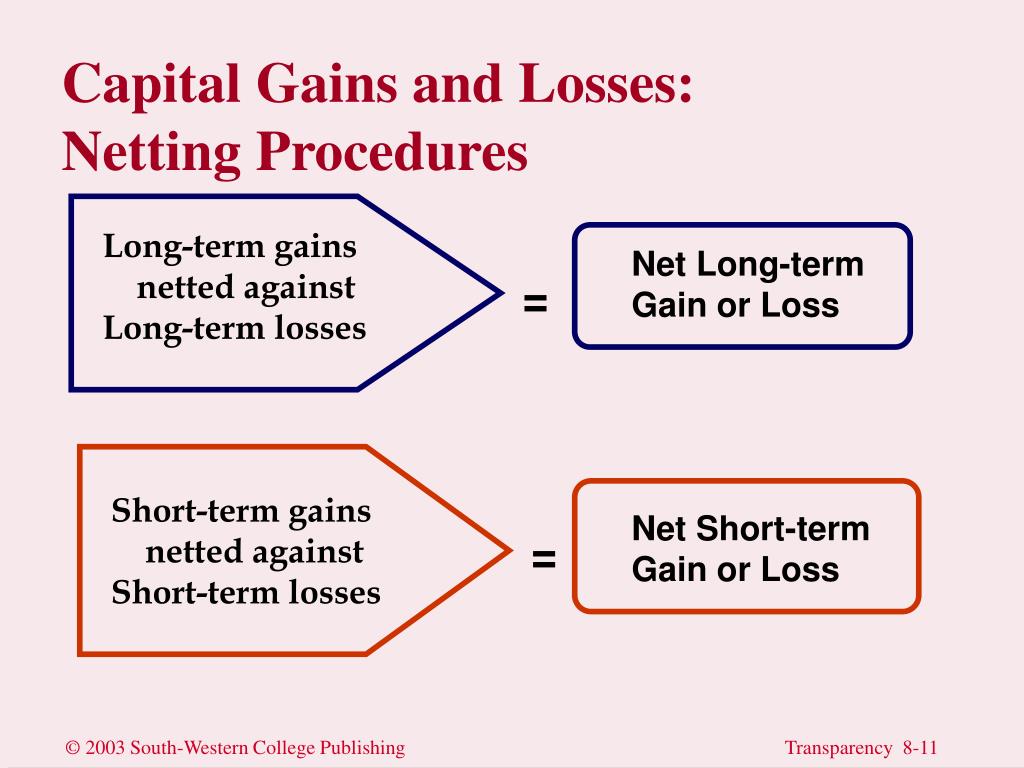

Income Tax Department, India - UNDERSTANDING CARRY FORWARD AND SET OFF OF LOSSES Income comes under five heads - salary, income from house property, income from business and profession, capital gain and

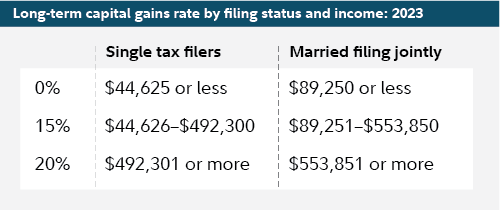

A Guide to the Capital Gains Tax Rate: Short-term vs. Long-term Capital Gains Taxes - TurboTax Tax Tips & Videos

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)

.jpeg)