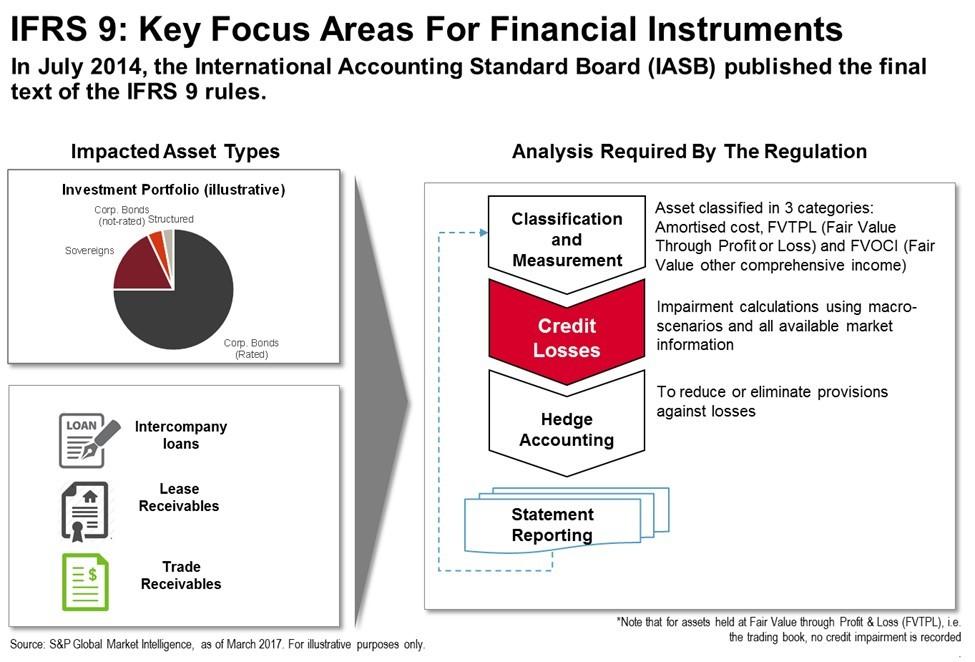

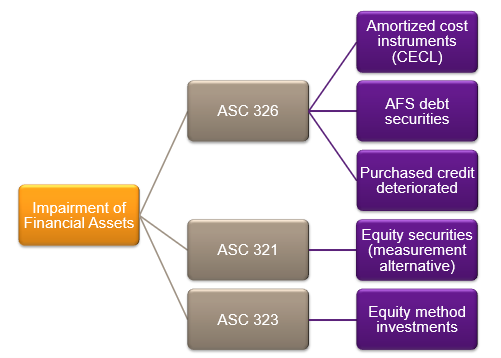

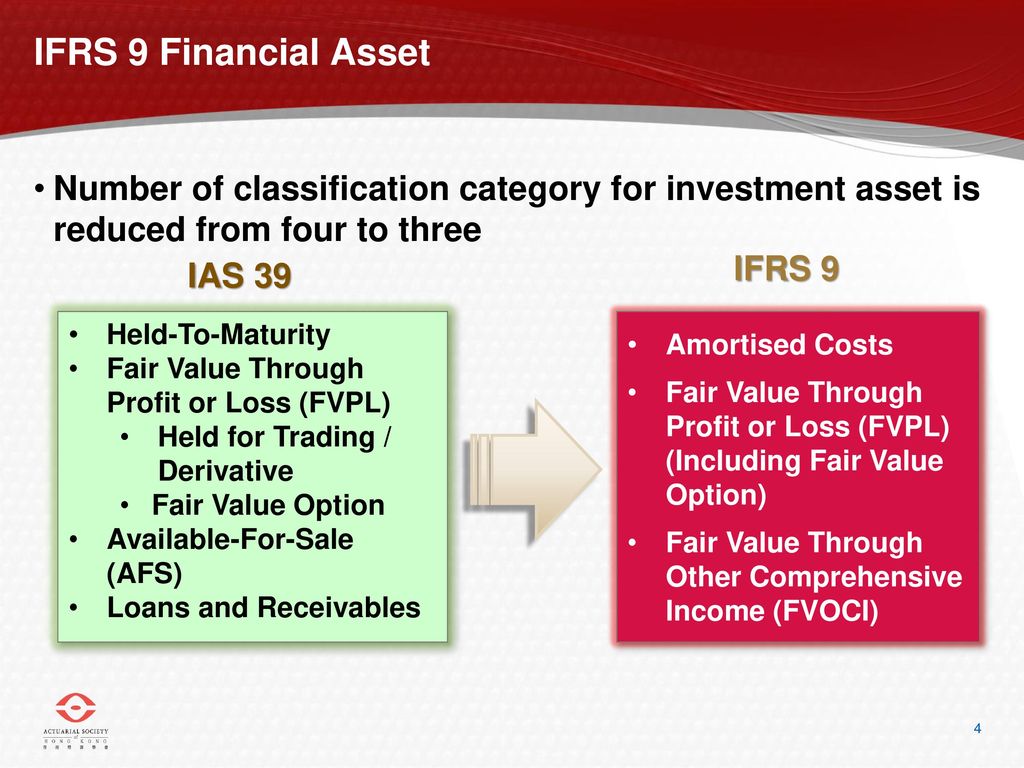

Classification, Measurement, and Disclosure under International Financial Reporting Standards (IFRS) for Intercorporate Investments - CFA, FRM, and Actuarial Exams Study Notes

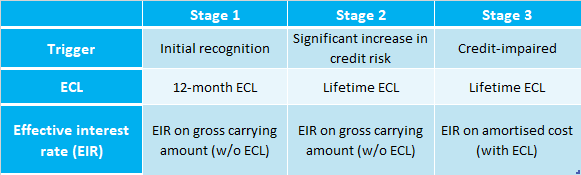

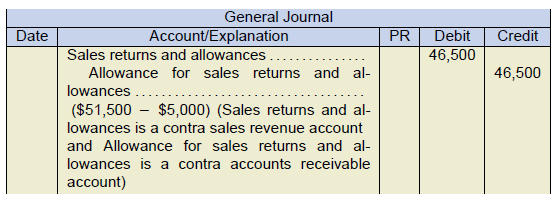

IFRS 9, simplified approach for trade receivables, policy, judgements and estimates and disclosures including credit risk – Accounts examples

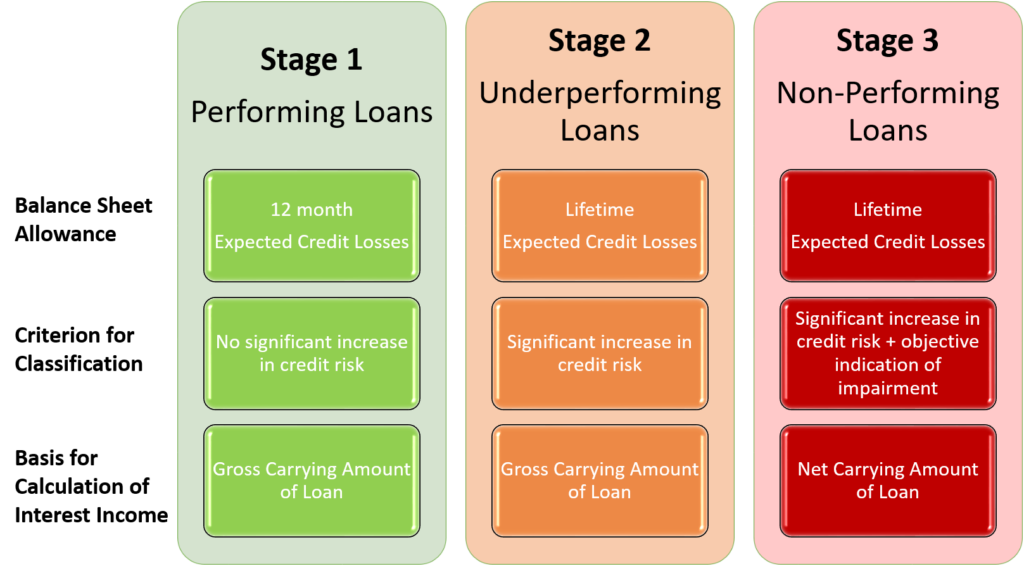

European Banks and the Q3/20 IFRS 9 Overlay – Fundamental vs. Technical Input to Accounting - VALUESQUE

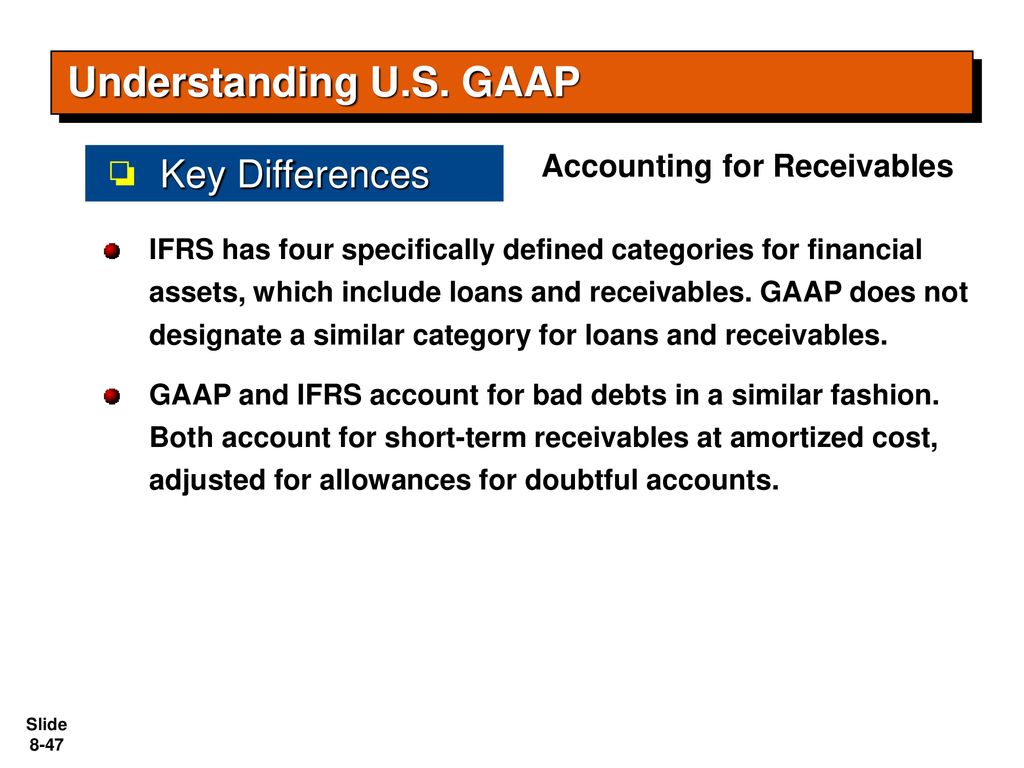

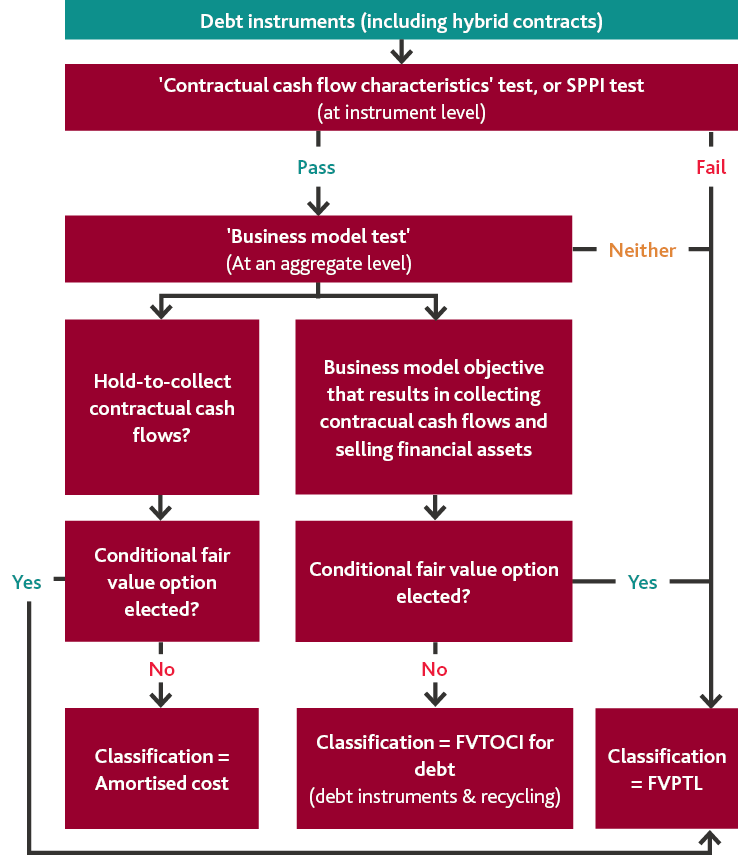

How will the new financial instrument standard impact business combinations when classifying financial assets under IFRS 9? - BDO

IFRS 9 — new approach to classification and impairment of financial assets - Korpus Prava. Publications

IFRS 9 FOR Receivables - Accounting policies Receivables Receivables are classified as loans and - Studocu

IFRS 9 para 5.5.15 simplified approach for trade receivables and contract assets, disclosures for receivables and contract assets and liabilities – Accounts examples